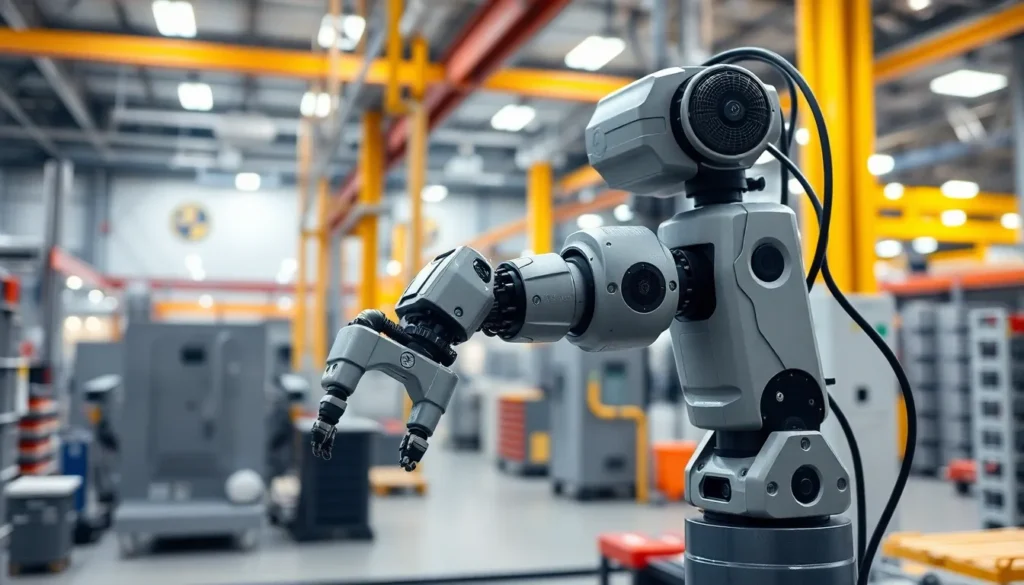

In a world where robots are no longer just for sci-fi movies, investing in reliable robotics stocks could be the next best thing since sliced bread—or at least since the invention of the toaster. With advancements in artificial intelligence and automation popping up faster than a cat meme on social media, savvy investors are looking to cash in on the robotic revolution.

Table of Contents

ToggleOverview of Reliable Robotics Stock

Reliable Robotics engages in the development of autonomous technologies for aviation. This company focuses on enhancing safety and efficiency in air transportation through innovative solutions. Recent advancements in its technology have positioned it as a key player in the aerospace sector.

Investors often highlight Reliable Robotics’ strategic partnerships with major aerospace companies. Collaborations include testing and deploying its autonomous systems, which enhance credibility in the market. The company’s ongoing projects showcase its commitment to revolutionizing cargo delivery and passenger transport.

Market analysts consider reliable revenue growth a significant advantage for Reliable Robotics. Financial reports indicate steady increases in earnings, driven by demand for automation in the aviation industry. Expansion plans signal potential for reaching new markets and increasing shareholder value.

Economic factors also play a role in influencing the stock’s performance. The rising emphasis on automation aligns with global trends toward improving operational efficiency. Consideration of these trends suggests a favorable outlook for investors in the robotics domain.

Stock performance fluctuates based on industry developments and technological advancements. Staying informed about market shifts allows investors to make educated decisions regarding Reliable Robotics. Overall, this company represents a promising investment opportunity in the dynamic field of robotics, particularly within aerospace innovation.

Key Players in the Robotics Industry

Investing in the robotics sector involves understanding the key players influencing the market. Several established companies and emerging startups shape this rapidly evolving landscape.

Major Companies to Consider

Leading corporations play a vital role in robotics advancements. Boston Dynamics continues to innovate with its robotic solutions, emphasizing agility and functionality. ABB Holdings specializes in industrial automation, offering modern robotic arms that improve manufacturing efficiency. Fanuc Corporation is known for its expertise in factory automation, providing cutting-edge robotics used in various industries. Lastly, Yaskawa Electric Corporation focuses on high-performance robots that enhance production quality in the manufacturing sector. Each of these companies offers insight into the future of robotics, showcasing reliable growth potential.

Emerging Startups

Innovative startups are also making significant strides in robotics. Diligent Robotics develops socially assistive robots designed to aid healthcare professionals, enhancing patient care through automation. In addition, Agility Robotics creates bipedal robots capable of navigating complex environments, positioning itself as a leader in advanced robotics. Additionally, Canvas Technology focuses on autonomous mobile robotics for warehouses and fulfillment centers, streamlining logistics operations. The contributions of these startups highlight the dynamic nature of the robotics market and present exciting investment opportunities.

Analyzing Market Trends

Investors increasingly recognize the value of robotics, driving significant market growth. Trends reveal strong interest in sectors integrating autonomous technologies.

Investment Growth in Robotics

Investment in robotics continues to surge, reflecting broader economic shifts. Statista reports that the global robotics market reached $39.8 billion in 2021 and is projected to exceed $102.5 billion by 2028. Leading firms, such as Reliable Robotics, attract investors due to strategic growth plans and robust revenue models. Many venture capitalists focus on emerging startups, identifying opportunities in healthcare and logistics automation. Growth in artificial intelligence fuels further investments, as companies build smarter, more efficient robotic solutions. Observing these trends helps investors align their portfolios with high-potential sectors within the industry.

Technological Advancements

Technological innovations drive the robotics sector forward. Recent advancements include enhanced artificial intelligence algorithms and more sophisticated sensor technologies. Companies like Reliable Robotics leverage these breakthroughs to improve safety and efficiency in aviation. High-profile collaborations among industry leaders foster accelerated development timelines for new technologies. Additionally, the rise of machine learning enables robots to learn from real-time data, increasing their adaptability and functionality. Continuous advancements position the robotics market as a dynamic field ripe for investment. Keeping a close watch on these technologies ensures investors remain aware of emerging opportunities.

Evaluating Stock Performance

Stock performance evaluation involves analyzing several key factors that influence potential investments in robotics companies. Understanding metrics and historical data helps investors make informed decisions.

Metrics to Watch

Investors should monitor earnings per share, or EPS, as it reflects a company’s profitability. Price-to-earnings ratio, or P/E ratio, indicates how much investors are willing to pay for a dollar of earnings. Revenue growth rates show how quickly a company is expanding, which is essential for assessing future potential. Market capitalization represents the total value of a company’s shares, signifying its size and stability in the sector. Dividends provide insight into a company’s profitability and shareholder returns, often being a positive sign for valuing stocks.

Historical Data

Analyzing historical stock performance offers valuable insights into a company’s reliability. Price trends from the past five years often reveal patterns that can help predict future movements. Comparing historical earnings reports against industry benchmarks helps assess a company’s growth trajectory. Shareholder responses to past earnings announcements often indicate market confidence. Additionally, stock volatility over previous periods informs about risks associated with the investment. Consistent performance during economic downturns underscores a company’s resilience in the market.

Reliable Robotics stands out as a compelling investment choice in the rapidly evolving robotics sector. With its focus on autonomous aviation technologies and strategic partnerships, the company is well-positioned to capitalize on the increasing demand for innovation in air transportation. As the global robotics market continues to expand, savvy investors will find ample opportunities in both established players and emerging startups.

Staying informed about market trends and key performance metrics will empower investors to make sound decisions. Reliable Robotics exemplifies how advancements in AI and automation can reshape industries, making it a noteworthy contender for those looking to invest in the future of technology.